Catastrophe Adjuster: Expert Help for Major Insurance Claims

Catastrophe Adjuster: Expert Help for Major Insurance Claims

Blog Article

Navigating Cases: Why You Need an Experienced Disaster Insurance Adjuster on Your Side

In the after-effects of a disaster, navigating the details of insurance policy cases can come to be a complicated task, typically aggravated by the psychological toll of the event itself. An experienced catastrophe adjuster is not simply a supporter but a vital companion in making sure that your insurance claims are assessed accurately and rather.

Understanding Catastrophe Adjusters

Disaster adjusters play an important duty in the insurance policy sector, specifically in the after-effects of considerable calamities. These specialists specialize in dealing with insurance claims connected to large occasions such as wildfires, quakes, and storms, which often result in widespread damage. Their know-how is essential for effectively analyzing losses and making certain that insurance policy holders get fair payment for their insurance claims.

The primary duty of a catastrophe insurance adjuster is to assess the extent of damage to buildings, lorries, and other insured properties. This involves performing thorough examinations, collecting documents, and collaborating with various stakeholders, consisting of insurance holders, contractors, and insurer. In several instances, disaster insurance adjusters are released to affected areas shortly after a disaster strikes, permitting them to supply prompt support and quicken the claims procedure.

Furthermore, catastrophe insurance adjusters have to possess a deep understanding of insurance coverage and policies to precisely translate insurance coverage conditions. Their logical abilities and interest to detail are crucial in determining the authenticity of claims and identifying any kind of prospective fraud. By browsing the intricacies of disaster-related insurance claims, catastrophe insurers play a vital duty in recovering the monetary stability of affected people and areas.

The Claims Refine Clarified

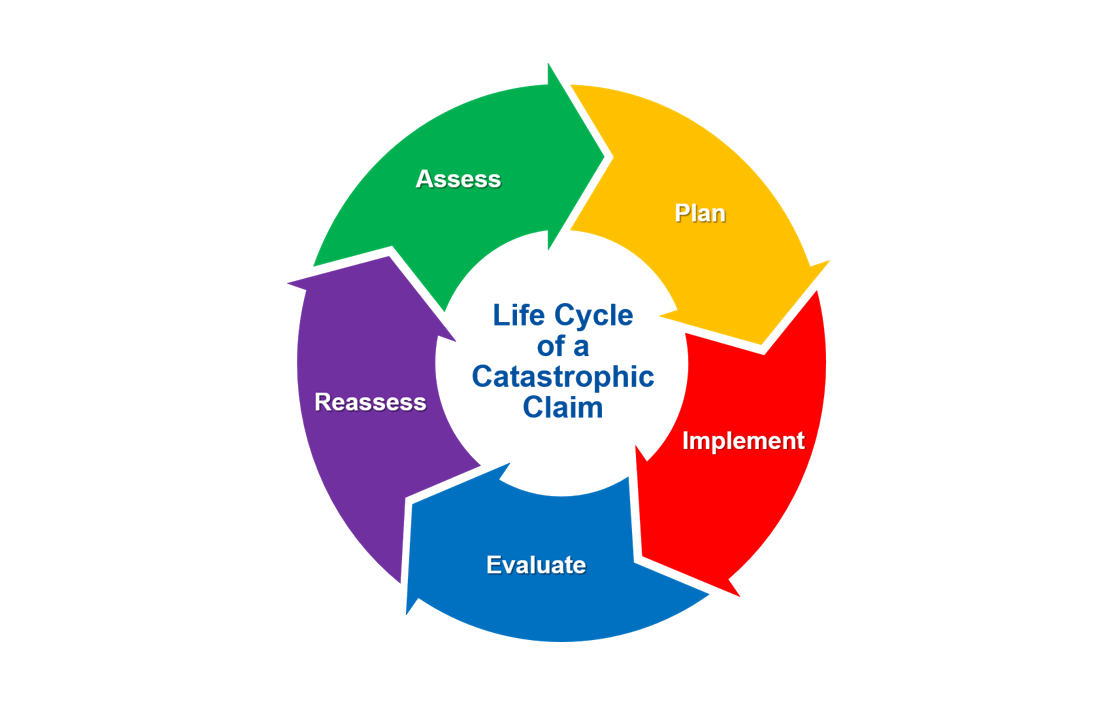

When a catastrophe strikes, comprehending the claims process is vital for insurance policy holders seeking payment for their losses. This process normally starts with informing your insurance coverage company concerning the occurrence, offering them with information such as the day, time, and nature of the damages. Following this preliminary record, an insurance adjuster will be assigned to assess your claim, which entails investigating the loss and figuring out the extent of the damages.

Documentation is a crucial element of the cases process. Insurance holders ought to collect proof, including photographs, receipts, and any type of various other important information that sustains their insurance claim. Once the insurance adjuster has actually conducted their evaluation, they will certainly submit a report to the insurer. This record will certainly describe their searchings for and supply a recommendation for payment based on the insurance holder's coverage.

After the insurance policy business reviews the insurance adjuster's report, they will decide regarding the claim. If approved, the insurance policy holder will receive payment based on the regards to their plan. Must there be any kind of disagreements or denials, even more settlements might ensue, possibly calling for extra documentation or reevaluation of the case. Understanding these steps can considerably help in navigating the intricacies of the cases process.

Benefits of Working With an Insurance Adjuster

Hiring an insurer can give various benefits for insurance holders navigating the claims procedure after a catastrophe. Among the main advantages is the knowledge that a competent disaster insurer offers the table. They possess in-depth expertise of insurance plan and case procedures, allowing them to precisely evaluate problems and supporter effectively for the a knockout post insurance holder's passions.

In addition, an insurance adjuster can reduce the anxiety and intricacy related to suing. They deal with interactions with the insurer, making click to find out more sure that all needed paperwork is sent promptly and appropriately. This level of company helps to accelerate the insurance claims procedure, lowering the moment insurance policy holders have to await compensation.

Additionally, insurance adjusters are proficient at discussing settlements. Their experience enables them to identify all possible damages and losses, which may not be promptly evident to the insurance holder. This detailed analysis can bring about a much more favorable negotiation amount, guaranteeing that the insurance policy holder gets a fair analysis of their insurance claim.

Selecting the Right Adjuster

Picking the ideal insurance adjuster is vital for ensuring a smooth claims process after a disaster. When confronted with the consequences of a catastrophic event, it is vital to select an insurer that possesses the best certifications, experience, and local knowledge. A proficient disaster adjuster must have a strong record of dealing with similar claims and be skilled in the ins and outs of your specific insurance plan.

When you have a shortlist, conduct meetings to assess their communication abilities, responsiveness, and desire to advocate for your passions. An experienced insurance adjuster needs to be transparent about the her response claims procedure and offer a clear outline of their costs. Finally, count on your instincts-- pick an adjuster with whom you really feel comfortable and certain, as this collaboration can significantly impact the outcome of your claim.

Typical Myths Unmasked

Misconceptions regarding catastrophe insurance adjusters can result in confusion and prevent the cases process. One typical misconception is that catastrophe insurers work solely for insurer. Actually, many insurers are independent professionals who advocate for policyholders, ensuring fair evaluations and settlements.

An additional misconception is that hiring a catastrophe insurer is an unneeded expense. While it is true that adjusters charge costs, their know-how can typically result in higher claim negotiations that far outweigh their prices, ultimately benefiting the insurance holder.

Some individuals believe that all claims will certainly be paid completely, despite the situation. Nonetheless, insurance plans often contain specific terms and problems that might restrict coverage. Understanding these nuances is important, and a skilled insurer can assist navigate this complexity.

Final Thought

In recap, the participation of a skilled disaster insurer significantly improves the cases procedure adhering to a catastrophe. Ultimately, the decision to engage a disaster insurer can have an extensive influence on the outcome of insurance claims.

In numerous instances, disaster insurers are released to affected areas soon after a calamity strikes, enabling them to give prompt aid and speed up the insurance claims procedure. - catastrophic insurance adjuster

A skilled catastrophe insurance adjuster should have a solid track record of dealing with similar claims and be well-versed in the complexities of your specific insurance policy.

Begin by investigating prospective insurers, looking for specialist classifications such as Licensed Insurance Adjuster or Accredited Claims Insurance Adjuster. catastrophe claims.Misunderstandings about disaster insurers can lead to confusion and impede the cases procedure.In summary, the involvement of a skilled disaster insurer substantially improves the insurance claims process adhering to a calamity

Report this page